Founded in 2011, Impossible Foods is an American agri-food company that develops plant-based substitutes for meat products. The company conducts R&D on animal products at the molecular level to select the protein and nutrients from plants to create products that provide the same nutrition and taste as meat, dairy, and fish products.

The firm’s flagship product, the Impossible Burger, was launched in July 2016. The company rose to prominence following its partnership with Burger King, who launched the Impossible Whopper in 2019. The same year, Little Caesars started using Impossible Food’s plant-based sausage products on its pizzas.

The success of Impossible Foods’ various products has rewarded it with a respectable $7 billion valuation.

Should investors expect an Impossible Foods IPO in 2022? If so, should you consider buying Impossible Foods stock when it IPOs?

Here is everything you need to know about Impossible Foods’ rumored 2022 IPO.

At writing, Impossible Foods products are sold in 22,000 supermarkets and 40,000 restaurants in four countries. In addition to its flagship Impossible Burger, the firm sells plant-based chicken nuggets, sausage, ground pork and meatballs.

However, the company believes the best is yet to come.

In 2020, its founder Dr. Patrick O. Brown declared that Impossible Food’s “mission is to replace the world’s most destructive technology – the use of animals in food production – by 2035. To accomplish that, we need to double production every year, on average, for 15 years and double down on research and innovation.”

This is obviously an ambitious goal.

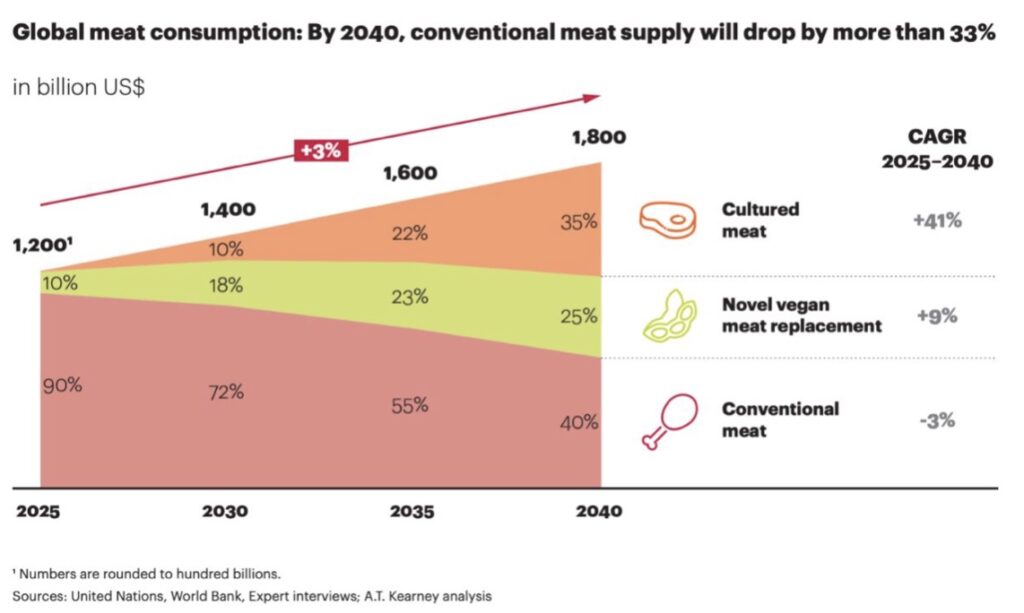

However, data suggests it may be realistic, given the rapid growth of the plant-based food market.

Swiss bank UBS claims that the plant-based meat market will reach anywhere between $51-72 billion in 2025, three-times what it is worth today.

Indeed, global consumers are drawn to plant-based products for environmental, animal welfare and health reasons.

Clearly, this is a sector with tremendous upside.

In 2021, Impossible Foods revealed its sales reached nearly $2 billion, an 85% increase from the year before. It is unknown if the company is currently profitable, but the fact that is has serious venture capital backing is a sign it is doing something right.

Crunchbase reports that since its creation in 2011, Impossible Foods has raised $2.1 billion in total funding. The firm’s recent fundraisers include a $500 million round organized by Mirae Global Investments in March 2021, and a $200 million round held in August 2021.

Impossible Foods’ notable investors include Horizons Ventures, Coatue Management, and a host of celebrities such as Bill Gates, Jay-Z, Peter Jackson and Serena Williams.

In April 2021, privileged sources revealed that Impossible Foods IPO would go public through a traditional IPO or a SPAC merger. Indeed, the sources claimed the company had received SPAC merger offers of $10 billion, but insiders are worried this path would dilute shareholder value more than a traditional IPO.

At present, it is still unclear when the company will go public.

Further, the current market conditions are not favourable for high-growth companies with little to no profitability. Tech stocks are getting crushed, and Beyond Meat – who is one of Impossible Foods’ fiercest competitors – has seen its stock price drop 43% since its 2019 IPO.

As always, investors should conduct their own due diligence before investing in any company. That said, investing before an IPO can be lucrative should the stock take off when it hits the public markets.

The information in this article is well-researched and factual. Still, it contains opinions also, and IT IS NOT FINANCIAL ADVICE and should not be interpreted as such, do not make any financial decisions based on the information in this article; we are not financial advisors. We are journalists. You should always consult with a professional before making any investment decisions.

© 2022 Market News 4U | All Rights Reserved.

Privacy Policy | Terms & Conditions

alert@marketnews4u.com | +353 (0) 1443 3250