On May 6th, 2022, Australian technology company Chrysos Corporation is going public on the Australian Stock Exchange (ASX) at a price of $6.50 per share.

With a $535 million valuation and an expected market capitalization of $637 million upon listing, the firm is expecting to raise anywhere between $183.5-200 million, which will make it Australia’s largest IPO since the start of 2022.

As the world witnesses rising inflation and geopolitical instability, investors are rushing to buy safe-haven assets, such as gold and other precious metals. Clearly, this bodes well for Chrysos Corporation’s bottom line and future growth.

So, should you invest in Chrysos Corporation’s $600 million IPO? Not necessarily.

Here is why:

Chrysos Corporation is a technology solutions company for the global mining industry with employees in Australia, North America, and Africa. Photon Assay, the firm’s flagship product, delivers accurate and environmentally friendly analysis of gold, silver and complementary elements. The powerful X-rays analyze rock samples to quickly and accurately determine the concentration of precious metals.

This is a crucial part of precious metal exploration, as the results of these tests determine whether companies invest in a certain area or concentrate elsewhere.

Chrysos Corporation’s business model is simple: clients lease the units, and Chrysos provides service and maintenance. Clearly, this approach is working.

The firm’s IPO filing revealed the company is in a healthy financial position and projects growing revenues based on the rising adoption of its technology by mining firms around the world. The board predicts $13.7 million in revenue and $925,000 of EBITDA in the fiscal year 2022 and expects these figures to rise to $26.6 and $3.2 million, respectively, in the fiscal year 2023.

Chrysos Corporation’s cutting-edge technology is disrupting legacy systems.

Chrysos Corporation’s cutting-edge technology is disrupting legacy systems

Still, despite these respectable numbers, Chrysos Corporation’s $600 million valuation means it is trading at an earnings multiple of 43.79, which is high, even for a growing technology company.

Thus, potential investors are worried that if the gold rally runs out of steam and miners scale back their activities, the share price could take a big hit.

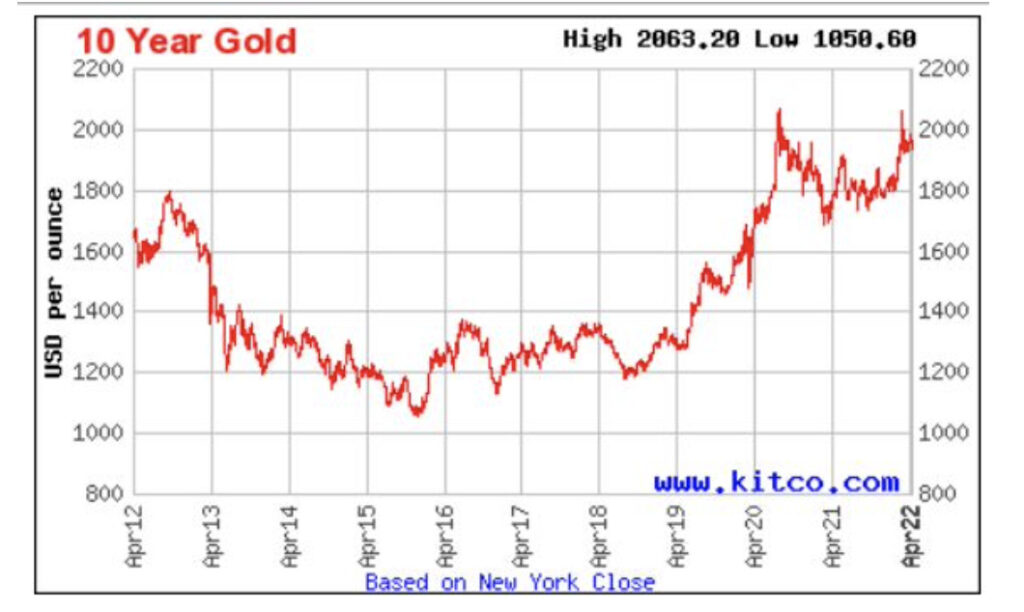

Gold prices have rallied and recently hit all-time highs. Naturally, companies involved in the sector are highly valued. However, some analysts fear this may not be ideal for Chrysos Corporation’s IPO prospects.

Gold prices are close to their all-time high – will the bubble burst this year?

Gold prices are close to their all-time high – will the bubble burst this year?

Indeed, investors fear investing “at the top” of the gold bubble. If gold prices reverse, they will be left holding an overpriced stock. Furthermore, the global context is pushing many investors to safe-haven assets, such as Blue-Chip companies and commodities, rather than growing companies with high earnings multiples.

Thus, some wonder if investing in Chrysos Corporation’s richly valued IPO makes sense in the current environment.

Investors should always conduct their own research before investing in any asset.

On the one hand, Chrysos Corporation’s technology is disrupting the gold analysis market by replacing slow, hazardous and costly processes. In this regard, it is well-positioned to continue growing and generating revenues.

On the other hand, gold’s impressive rally will not continue forever. At some point, the geopolitical situation will ease, and central banks will bring inflation under control. Of course, it remains unknown when these two events will occur, but when they do, the price of gold will correct, and gold-related stocks should also correct.

Thus, while investing in Chrysos Corporation’s IPO is tempting, it remains a high-risk, high-reward play that may or may not deliver the expected shareholder value. Invest at your own risk.

The information in this article is well-researched and factual. Still, it contains opinions also, and IT IS NOT FINANCIAL ADVICE and should not be interpreted as such, do not make any financial decisions based on the information in this article; we are not financial advisors. We are journalists. You should always consult with a professional before making any investment decisions.

© 2022 Market News 4U | All Rights Reserved.

Privacy Policy | Terms & Conditions

alert@marketnews4u.com | +353 (0) 1443 3250