A real estate investment trust (REIT) is a company that primarily invests in real estate. In Australia, these entities are referred to as A-REITs.

A-REITs invest in various types of real estate including – but not limited to – residential properties, office buildings, industrial property, and shopping malls. In sum, any properties that can be rented, leased, or bought and sold for a profit fall in the scope of an A-REIT’s mandate.

Historically, real estate is a fantastic hedge against inflation, as property prices steadily increase over time. With Australian inflation rates affecting the nation’s purchasing power, investors are considering real estate investing as a way to protect their wealth.

Here is a list of the top 5 A-REIT stocks, buy to hedge against inflation.

Founded in 1989 by Gregory Goodman, Goodman Group is an A-REIT that invests primarily in warehouses, large-scale logistics facilities, as well as business and office parks in Australia and around the world.

With a dividend yield of 1.31% and a total return of 191% over the past 5 years, this is one of the best A-REITs stocks Australian investors can purchase.

Second on our list is Dexus Property Group, an A-REIT with a real estate portfolio valued at $42 billion.

Contrary to most A-REITs, Dexus invests exclusively in Australia, where it owns $17.5 billion worth of office, industrial, and healthcare properties located in Sydney, Melbourne, Perth, and Brisbane. In addition, Dexus manages an additional $25 billion worth of the same types of properties on behalf of third parties.

While this A-REIT’s stock price has not yet recovered from the broad COVID-19 sell-off, it presents an attractive 4.68% dividend yield that income-seeking investors may consider snapping up before the stock price fully recovers.

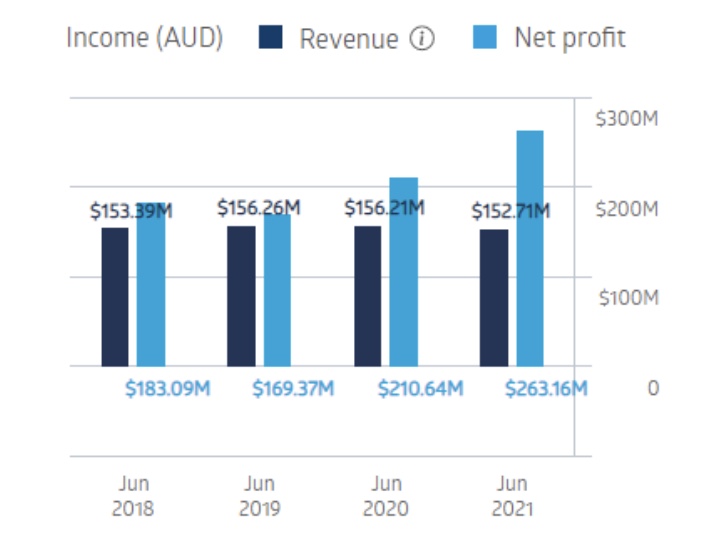

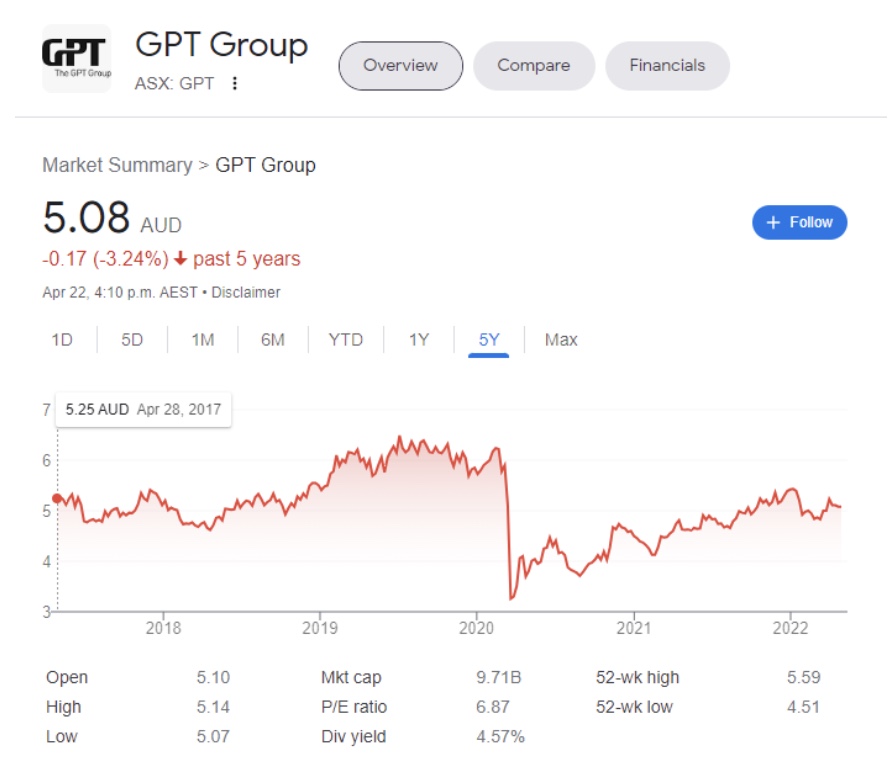

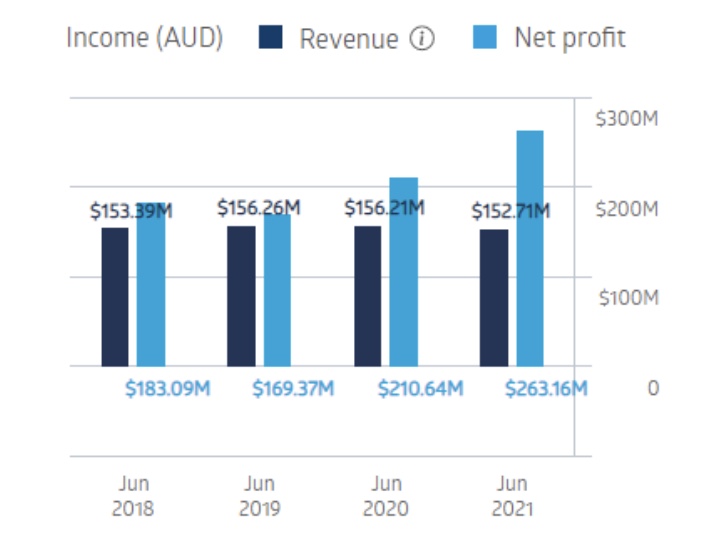

GPT Group is arguably one of the largest and most diversified A-REITs listed on the ASX. Indeed, GPT is specialized in active ownership of retail office logistics and business park assets. In total, GPT Group’s portfolio value exceeds $20 billion.

Much like Dexus, GPT Group’s stock price has yet to recover from its COVID-19 lows. However, this is good news for dividend lovers, as the stock currently offers a 4.5% dividend yield.

What’s more, GPT Group is a leader on the Dow Jones Sustainability Index and undeniably one of the best A-REIT stocks when it comes to international sustainability benchmarks.

The fourth best A-REIT stock on our list is Charter Hall Group, a property group that manages listed and unlisted property funds on behalf of its wholesale, institutional, and retail clients.

With a total return of 172% since 2017 and a dividend yield of 2.46%, this A-REIT stock is an interesting option for investors looking for both capital appreciation and regular income.

The fifth A-REIT stock on our list is BWP Trust, a property management firm that was created in 1998.

Headquartered in Australia, this A-REIT is smaller than the other mega-firms listed in this article, but don’t let that fool you, as it is also one of the most profitable. Indeed, its recent quarterly financials reveal this A-REIT generated $174 in net income, and a profit margin of 459%!

These stellar results explain why this A-REIT stock has generated a total return of 43% since 2017, and currently offers a very attractive dividend yield of 4.38%.

The information in this article is well-researched and factual. Still, it contains opinions also, and IT IS NOT FINANCIAL ADVICE and should not be interpreted as such, do not make any financial decisions based on the information in this article; we are not financial advisors. We are journalists. You should always consult with a professional before making any investment decisions.

© 2022 Market News 4U | All Rights Reserved.

Privacy Policy | Terms & Conditions

alert@marketnews4u.com | +353 (0) 1443 3250