Like most developed countries, Australia is faced with high inflation rates and an uncertain economic outlook. As the world reopens, central banks are trying to figure out how to curb price increases without provoking full-blown recessions.

Thankfully, the Australian economy may be resilient enough to avoid the most catastrophic scenarios.

In the 4th quarter of 2021, Australia’s annual inflation rate rose to 3.5%, up from 3% the in the third quarter. For most ordinary people, this number seems low. And it is: this calculation is an average of a basket of goods and doesn’t factor in housing, which rose 22% in 2021. In reality, the average household sees prices much higher than the official figures suggest.

These inflationary pressures will have profound effects on the economy.

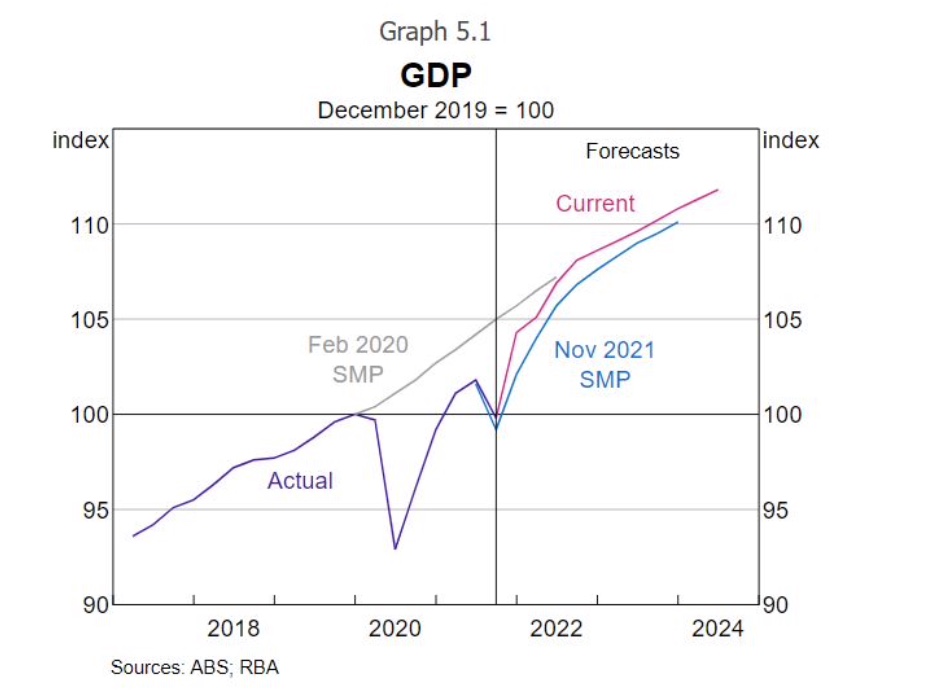

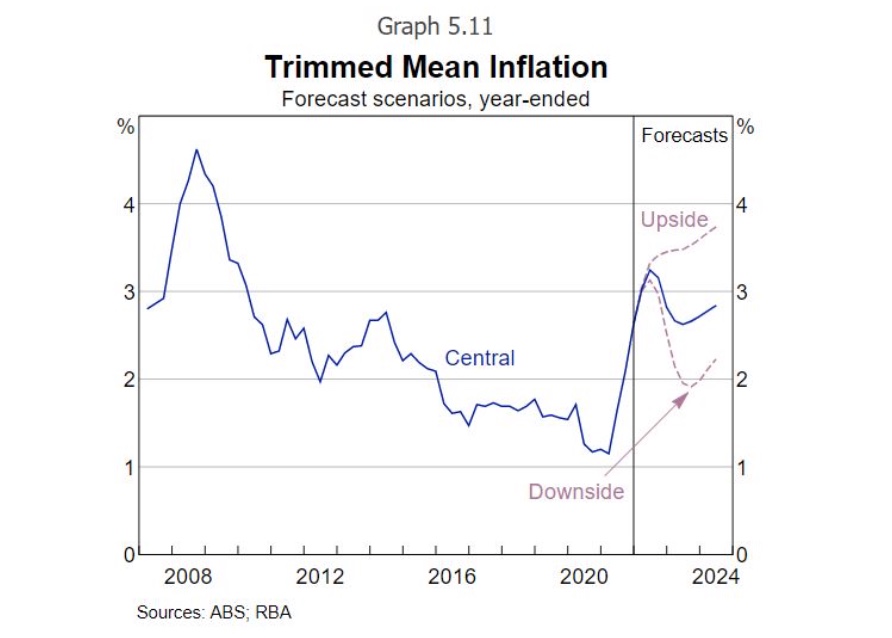

Indeed, the Reserve Bank of Australia predicts that inflation rates will increase to 3.75% by June 2022, before slowly decreasing to 3.25% in December 2022, and then 2.75% in 2023, if a favorable scenario unfolds. In parallel, economic growth will slow from 5% in June 2022 to 4.25% in December 2022, then 2.5% in June 2023 and 2% in December 2023.

This suggests that GDP growth is tied to inflation rates, which means that while the nominal GDP is increasing, the real GDP is either stagnant or increasing at a much slower pace.

The central bank predicts continued economic growth, which bodes well for the Australian economy.

Clearly, the Australian economy is far from rosy.

Now that the pandemic is coming to an end, the central bank is concerned about the adverse effects of skyrocketing prices on the economy at large, as core Australian inflation rates are well above the bank’s 2-3% target rate.

Also, readers should be mindful that the central bank’s predictions are based on optimistic scenarios, so it is entirely possible that the real Australian inflation rates will be much higher, if the central doesn’t act swiftly and decisively, or if the overall context is worse than expected.

The central bank’s April policy meeting minutes reveal that the board is seriously considering increasing interest rates in the coming months. However, the challenge is to increase interest rates without provoking a full-blown recession. Central banks in Europe and America face the same challenge, although both the Canadian Central Bank and the Federal Reserve have already increased their respective discount rates over the past weeks.

The situation in Australia is slightly different, as a robust job market may grant the central more flexibility when it comes to increasing interest rates.

The most favorable outcome for Australian inflation rates and economic growth is the swift resolution of Omicron, which would boost consumer confidence and encourage households to spend the wealth they accumulated during the pandemic. In this scenario, unemployment would drop to 3% by 2024, but inflation would remain above 3% due to continued supply chain constraints. In any case, the economy and job markets would be strong, and inflationary pressures would be contained.

In favorable and unfavorable scenarios, inflation is forecast to hover around 2-4% until 2024.

The most unfavorable scenario involves continued Coronavirus outbreaks and restrictive health measures. This would clearly affect consumer confidence and drastically reduce discretionary spending. If this were to happen, unemployment would remain high, in the 4-5% range, and the restrictions would exacerbate existing supply chain issues. However, the tight labor market would help contain Australian inflation rates, which would hover in the 3-4% range.

In all scenarios, Australia’s central bank is relying based on the labor market to keep inflation rates under control. In fact, interest rate increases are almost considered secondary by the bank.

Investors should pay close attention to company fundamentals, such as earnings, debt burdens, profits, and free cash flows. In this uncertain environment, value is preferable to growth, and adopting a conservative approach is recommended.

The information in this article is well-researched and factual. Still, it contains opinions also, and IT IS NOT FINANCIAL ADVICE and should not be interpreted as such, do not make any financial decisions based on the information in this article; we are not financial advisors. We are journalists. You should always consult with a professional before making any investment decisions.

© 2022 Market News 4U | All Rights Reserved.

Privacy Policy | Terms & Conditions

alert@marketnews4u.com | +353 (0) 1443 3250