Indeed, inflation is hitting record levels on every continent:

The coronavirus pandemic and the war in Ukraine have unleashed severe monetary and economic instability on the world markets.

Rising prices are one of the most pressing issues facing politicians and central banks in 2022. The question is: will the central banks increase rates given the challenging economic context?

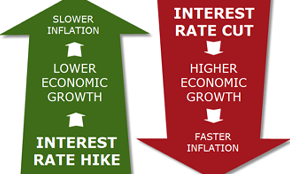

Interest rates are arguably the most important monetary tool in policymakers’ arsenal. The rate set by central banks determines the price of short-term lending: the lower rate, the cheaper credit is for individuals and businesses.

The danger of low rates is that it fosters monetary expansion. If too much money is injected into the economy, prices increase to capture excess liquidity. This is the situation we are in today: quantitative easing combined with covid-related supply chain disruptions resulting in record inflation rates.

Thus, it is evident that central banks need to raise rates to contain inflation. Indeed, most central banks’ mandates clearly state that their mission is to keep inflation under 2% - and they are well off the mark. Increasing rates is arguably the only conceivable way to bring inflation under control.

It is easy to say that rates should be increased quickly to lower inflation.

However, things aren’t so cut and dry.

An increase in interest rates means that credit becomes less affordable. As a result, individuals and businesses must pay higher interest rates to borrow money. This means mortgage rates go up, and families must either delay or cancel home-buying plans. In parallel, businesses must scale back their investments or downsize to fund capital expenditure projects. Often, this results in lower economic growth.

The danger is that if the economy is not ready to absorb a rise in the cost of credit, a rapid increase in interest rates may cause a recession. Thus, central banks must proceed with caution.

At the end of 2021, central banks were adopting hawkish tones to prepare the markets for several rate increases over the next two-three years. However, Russia’s invasion of Ukraine has disrupted their plans.

Indeed, the Ukraine crisis has sent energy prices soaring, which means that inflation will rise even more for the foreseeable future. Consequently, individuals have the less purchasing power to allocate discretionary expenses, which will profoundly impact corporate profitability.

For example, BlackRock analysts believe the Eurozone will suffer high inflation and low economic growth over the next few years. Raising interest rates too quickly could create stagflation – a situation where inflation and growth are low. This is bad for all parties.

In any case, while the Federal Reserve and the European Central bank appear committed to raising rates at a slow albeit regular pace, BlackRock concludes that the banks will resist steep increases and blame the rising inflation on Russia.

Will this be enough to contain widespread unrest?

Only time will tell.

The information in this article is well-researched and factual. Still, it contains opinions also, and IT IS NOT FINANCIAL ADVICE and should not be interpreted as such, do not make any financial decisions based on the information in this article; we are not financial advisors. We are journalists. You should always consult with a professional before making any investment decisions.

© 2022 Market News 4U | All Rights Reserved.

Privacy Policy | Terms & Conditions

alert@marketnews4u.com | +353 (0) 1443 3250