You’d be forgiven for thinking that everything that Elon Musk touches turns to gold. Lately, we’ve seen the entrepreneur rise to a level of success that few can fathom – with Tesla and SpaceX achieving mainstream traction on the back of his initial involvements in PayPal. Starlink is an exciting company growing in the shadow of SpaceX, and its recent growth has certainly caught the eye of investors across the globe.

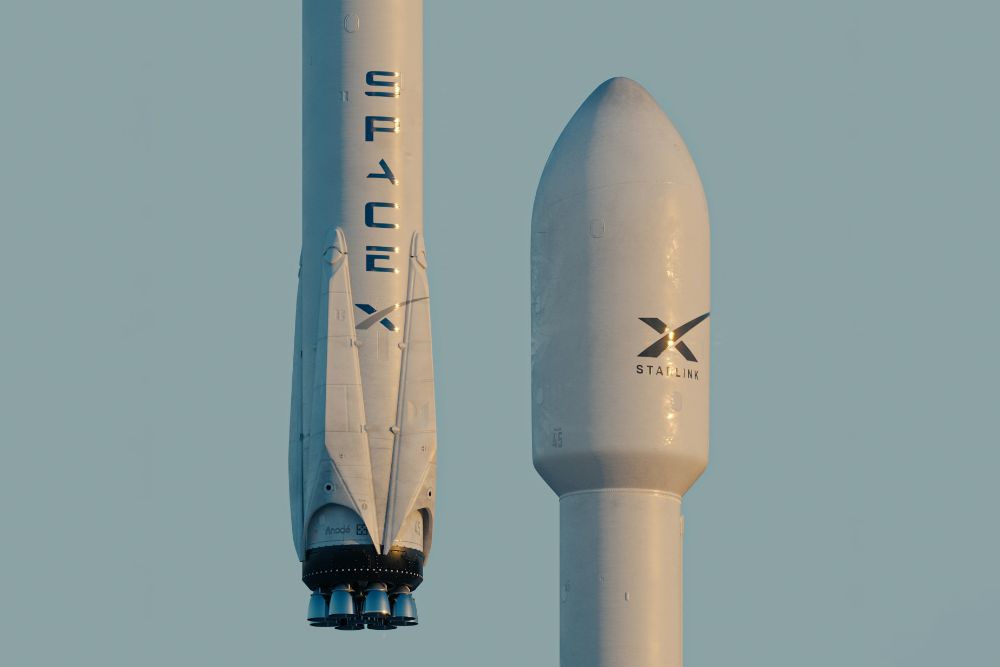

Starlink is a satellite company that operates under the SpaceX umbrella. The company is focused on using a complex network of satellites to provide high-speed, low-latency broadband to users across the world. The technology deployed tends to perform even better than traditional satellite internet, leveraging all the accumulated knowledge that SpaceX has garnered during the past couple of years. The mission is to make internet access affordable and accessible to all – but particularly to remote and rural areas that are still disconnected from mainstream internet infrastructure.

Until now, it has remained a supporting act to SpaceX and its public-facing momentum. But if you listen to the rumours, the company looks set for its own IPO and a real coming-of-age moment as it starts to leverage the product-market fit it seems to have found.

After adding only 11,000 new subscribers per month through 2021, it came as a big surprise to investors when the company announced that in the first quarter of 2022, they had increased their total subscriber base to 250,000 across individual and enterprise users. This computes to an additional 105,000 new subscribers in just three months, up 74% from where they were at the beginning of the year.

Many showed some scepticism about the accuracy of these numbers because of the orders of magnitude jump that the company claims to have taken. In addition, the company faced the same inflationary and supply chain pressures that many others have, and was forced to increase prices significantly to account for the increased costs.

As a result, the current standing of the company is a mixed bag with many investors unsure of where the company will be able to go in the future. However, for those who believe in the mission of the company and its talisman Elon Musk, it also represents an opportunity to jump on the next rocket ship if they can achieve the scale they’re hoping for.

From a product perspective, Starlink is well-placed to bring widespread internet access to the vast portions of our global population who still don’t have reliable access. For just $600, a user can buy the Starlink terminal and then access high-speed internet for $110 per month. These costs will likely come down over time as the satellite network matures and inflation settles to a more reasonable level after the post-pandemic hangover.

The company has been very vocal about its goal of having 40 million subscribers by 2025 – a long way to go from here, but something that seems achievable when you consider the sheer size of the target market here. Research from Morgan Stanley muted these numbers and suggested that the company was only on track to reach that figure by 2029, where the pricing would likely be in the $25 per month range. This places the estimated revenue at the end of the decade at around $12 billion.

This is nothing to sneeze at and if you believe the company’s projections, this would represent a significant underestimate of the potential here. Elon Musk has continually bucked analyst sentiment, and so you’d be brave to bet against him here. In the race for satellite supremacy, he still holds the keys, and so if you believe in the industry as a whole – this seems like the place to focus your attention.

In addition, we can’t ignore the socio-political impact that the company has had so far, and its role going forward. As Russia invaded Ukraine, Starlink stepped in to provide satellites for the country to enable the government, the armed forces, and the citizens themselves to stay connected as the war continues to drag on. This is just one example of how Starlink’s established presence and capability for high-quality broadband can be so transformative. If you believe that they’ll continue to play this role in the future, then there are lots more to come from the company.

This is certainly a space to watch, especially as the IPO rumours continue to make waves. As the company grows and achieves better economies of scale, we’ll continue to watch with bated breath as to what it means for investors who want a part of this burgeoning satellite ecosystem.

The information in this article is well-researched and factual. Still, it contains opinions also, and IT IS NOT FINANCIAL ADVICE and should not be interpreted as such, do not make any financial decisions based on the information in this article; we are not financial advisors. We are journalists. You should always consult with a professional before making any investment decisions.

© 2022 Market News 4U | All Rights Reserved.

Privacy Policy | Terms & Conditions

alert@marketnews4u.com | +353 (0) 1443 3250