Financial markets are dealing with the Federal Reserve’s policy changes, while geopolitical challenges continue to weigh on the global economic outlook.

The S&P500 has seen five consecutive weekly declines, the worst record since June of 2011. Stocks attempted a rally the first week of May before being hit by the worst daily drop since the pandemic’s start. Friday saw a decent recovery, but futures continue to look bad.

Globally, the picture is not much better. When looking at the MSCI World index, global markets are down 18% year-to-date. If we were to reach, a20% decline, the dreaded “bear market” would be attained. Don’t be shocked if this does happen.

What is behind these swings? First, the financial markets are reacting to the surprise Federal Reserve policy change. The markets have become accustomed to the loose monetary policy for 20 years, and investors don’t know how to deal with a Fed that is pulling back in an attempt to slow the economy.

The uncertainty is exacerbated by the continuous Chinese lockdowns, rising inflation, supply concerns, and energy price spikes, complicating the global economic outlook. Some on Wall Street see a promising future; Goldman Sachs expects an equity market recovery, saying that the markets and the Fed’s moves have set the stage for “stabilization.”

Bitcoin fell to its lowest level seen since July 2021, while tech companies of all sizes are feeling price pains. Meta, Peloton, and Netflix are all down significantly, all losing more than 50% YTD.

To return to their pre-pandemic prices, they would need to lose another 25%; for cryptos, the drop would be an additional 60%.

The reasons behind the market crashes, inflation, rising interest rates, and the fuel crisis worsened by the Russian war in Ukraine all intersect, which makes each one worse. When combined, the collection further hurts investor sentiment.

When 2022 began, investors were starting to process the consequences of higher interest rates, which were needed to combat the rising inflation but would also harm stock returns and the returns of highly valued bonds. We then add to this issue the Russian invasion and subsequent war in Ukraine, which caused an immediate spike in the already high-energy prices. The global reliance on fossil fuels fed further inflation overall. With it, the snowballing need for accelerating interest rate rises and inflation hurt the overall global economic growth and led to recession anxiety. Food shortages are even possible with the Ukraine war; it is estimated that they are only planting 25% of their crops, which being one of the world’s bread baskets, would cause inflation of food worldwide.

Markets have been processing this long-term negative data that includes a high degree of uncertainty and trying to figure out what will happen going forward. As is normal, conservative markets seem to be pricing in the worst-case scenario. If the Data Trek research is right, the S&P is on track to produce its worst year-to-date returns in six decades. But are things that bad, or are we overcorrecting?

The latest news is not great, but also not getting worse. The annual U.S. inflation numbers for the April CPI were 8.3% which is high but slightly lower than the 8.5% seen in March.

For the past decade, FANG stocks and Groth have been “the places” to invest. Besides the losses seen, there has been a significant decline in the top stocks of the stock markets. For several years the U.S. tech giants have attempted to be the world’s largest market cap company. Apple has edged ahead of Microsoft and kept Alphabet(Google) and Amazon from the top spot with a market value exceeding $3 trillion on January 1, 2022. Tech and growth companies have suffered from inflation and interest rate hikes that devalued their futures. Other companies have benefitted from the same playing field, and the now largest market cap company is Saudi Aramco, whose profits and price have flourished.

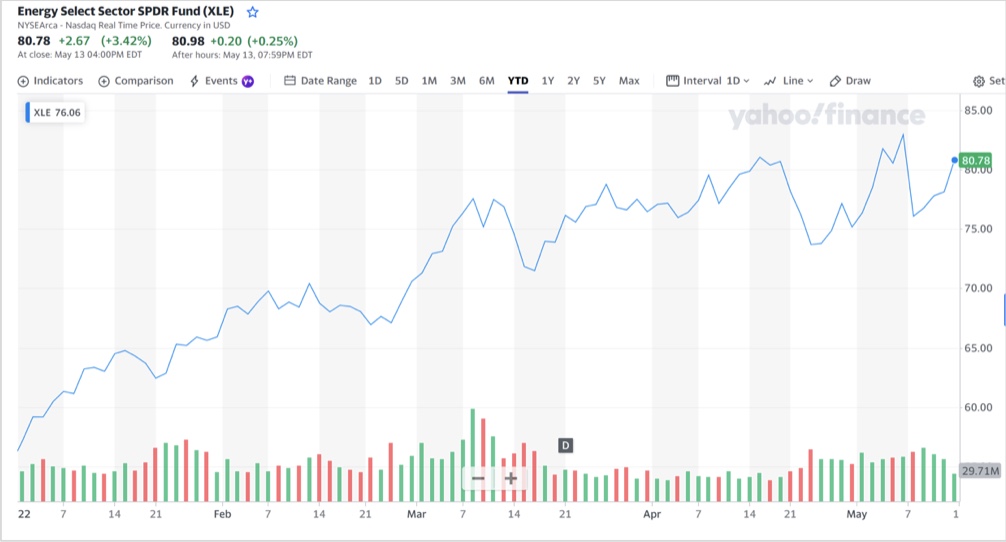

Reassessing the possible overvaluation of tech in the current environment has resulted in a hard fall. Oil and energy are a bright spot for2022 investors; the Energy Select Sector SPDR Fund (XLE) is up over 42% year to date.

We are probably looking at a long summer and possibly a bear market globally. There is no end in sight to the war in Ukraine, and until inflation comes down and rates stop rising and can at minimum remain flat, we will likely see a continued overcorrection in the markets. We may not have seen the bottom yet, and once we do, there may be a slow recovery, but some sectors have benefitted from the current playing field, and like always, there will be others that benefit as things change.

The information in this article is well-researched and factual. Still, it contains opinions also, and IT IS NOT FINANCIAL ADVICE and should not be interpreted as such, do not make any financial decisions based on the information in this article; we are not financial advisors. We are journalists. You should always consult with a professional before making any investment decisions.

© 2022 Market News 4U | All Rights Reserved.

Privacy Policy | Terms & Conditions

alert@marketnews4u.com | +353 (0) 1443 3250