Earlier this year, Jack Dorsey’s fintech company Block Inc acquired Afterpay, an Australian “Buy now, pay later” (BNPL) fintech startup, for a whopping $29 billion.

Shortly after, Block Inc decided to list on the ASX (ticker: SQ2), a move which may spur other major Australian technology companies, such as Atlassian and Canva, to do the same. In fact, Max Cunningham, Group Executive of Listings at the ASX, says this was the most important listing on the Australian markets in 200 years.

That is a very bold assertion, but Block Inc’s listing is a sign that major companies believe the Australian market is poised for massive growth over the coming decades.

Should Australian investors buy Block Inc stock on the ASX?

Formerly known as Square, Block Inc is a financial service and digital payments company, with various product offerings:

With more than 8,500 employees and over $17 billion in revenues, Block Inc is disrupting the financial services industry and quickly establishing itself as a household name in the world of fintech.

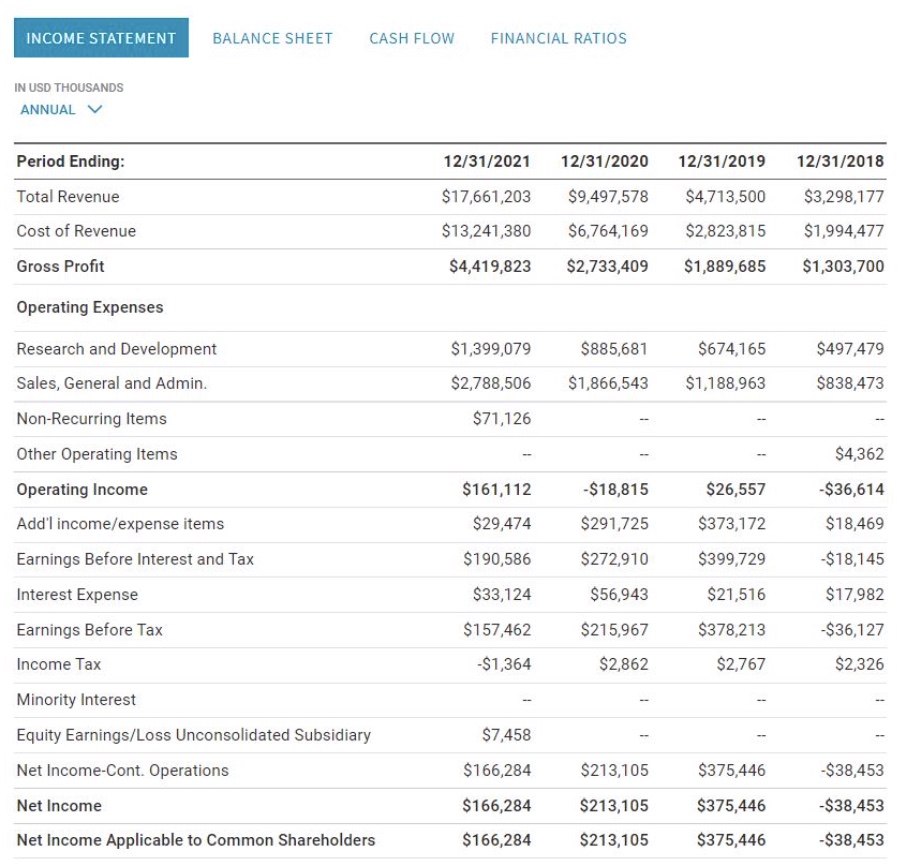

While Block Inc’s revenues increased nearly twofold since 2020, rising to $17.6 billion in 2021 from $9.4 billion the year before, the firm’s profitability is still an area of concern.

Indeed, Block Inc’s 2020 net income is only $166 million, down 55% from 2019, when revenues were four times less than they are today. The main problem appears to be the costs associated with doing business: 2021 cost of revenue increased 95% from 2020, which is more than the 85% growth in revenue!

High growth tech companies are notorious for burning cash to grow; however, current market conditions are not favourable to tech companies with outrageous earnings multiples. At present, Block Inc’s Price to Earnings Ratio (P/E) is a mind-boggling 339. To put that in perspective, PayPal, who generated net profits of $4 billion in 2021, has a P/E ratio of just 24.

Upon acquiring Afterpay, Block Inc immediately made it available to its US and Australian business clients. This move enables Block Inc to increase its value proposition to merchants, which should theoretically increase loyalty and boost sale volumes.

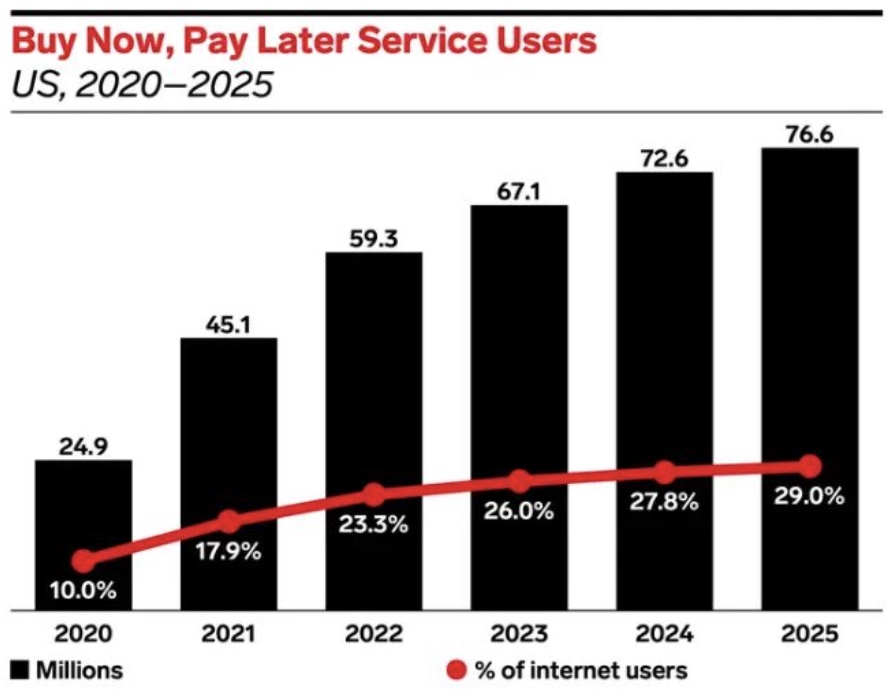

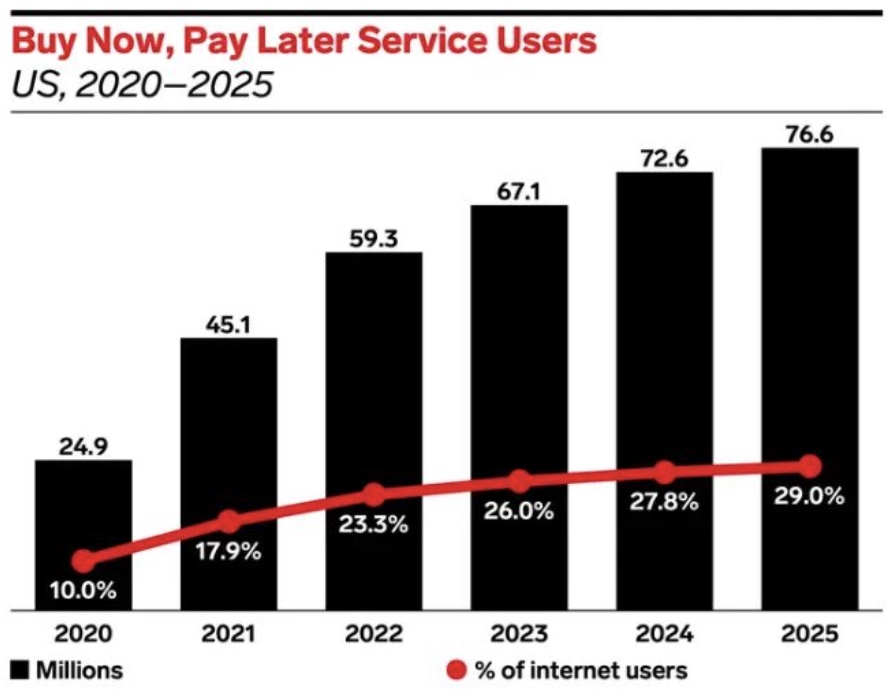

Indeed, Buy Now Pay Later (BNPL) is a popular option among e-commerce shoppers. Not only is the number of total BNPL users expected to grow by more than 30% this year, an RBC study suggests BNPL boosts conversion rates by 20-30% and increases the average ticket size by 30-50%. This is music to retailers’ ears.

In sum, BNPL is a rapidly growing market, and it is expected to grow by more than 20% every year until 2025, at which time the total market size will exceed $76 billion.

Will the acquisition of Afterpay help Block Inc deliver consistent profits?

Maybe.

Block Inc is far from the only fintech company trying to dominate the digital payments market. Other leading firms such as PayPal – who is actively expanding Zettle, its small business point of sale solution – Klarna, PayU, ACI Worldwide, Intuit, Fiserv Inc, and Stripe, are all competing in the same rapidly growing, but fiercely competitive market.

Thankfully for these companies, merchants usually work with multiple vendors, so there is space for each to continue growing. However, each firm is busy trying to develop competitive advantages, and Block Inc is no exception.

In December 2021, Jack Dorsey decided to rename the company Block Inc to associate it more closely with the high-growth cryptocurrency space, which is based on Blockchain technology.

This may be Block Inc’s opportunity to unlock shareholder value.

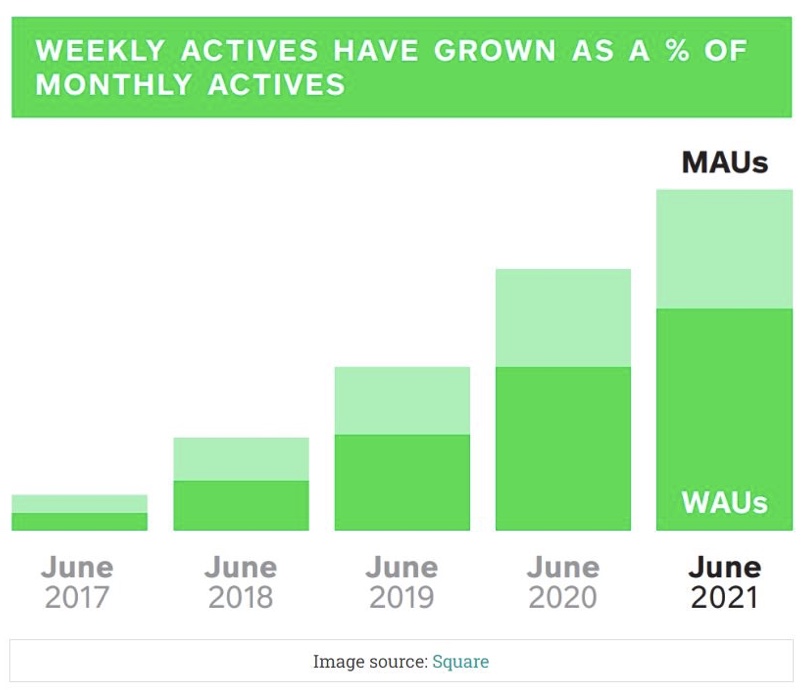

Indeed, Block Inc’s Cash App generated $10.01 billion of Bitcoin revenue and $218 million of Bitcoin gross profit, up 119% and 124% year over year, respectively. Given the rapid rise in cryptocurrency adoption, this may drive Block Inc’s profitability. Indeed, Cash App had 44 million monthly active users in Q4 2021, and 13 million people now have a Cash App card.

Further, Block is rumored to be developing a Bitcoin hardware-wallet and a Bitcoin mining system, two features which will enhance its competitive advantages in the crypto space over its competitors. In turn, this allows Block Inc to bring cryptos into its seller ecosystem, and enable Afterpay to do so as well.

Block Inc is an innovative fintech company with a bright future. However, it faces stiff competition in the digital payments space, but its venture into cryptocurrency provides an avenue of growth that others have yet to explore fully. Thus, Australian investors interested in gaining exposure to digital payments and crypto may consider Block Inc a worthwhile long-term investment, provided they also have a high-risk tolerance.

The information in this article is well-researched and factual. Still, it contains opinions also, and IT IS NOT FINANCIAL ADVICE and should not be interpreted as such, do not make any financial decisions based on the information in this article; we are not financial advisors. We are journalists. You should always consult with a professional before making any investment decisions.

© 2022 Market News 4U | All Rights Reserved.

Privacy Policy | Terms & Conditions

alert@marketnews4u.com | +353 (0) 1443 3250